Convicted Norwegians connected to companies valued at six billion

But the company's turnover this year is almost zero.

The four Norwegians Ole Petter Lindegaard, Leiv Are Kristiansen, Kristian Helgesen and Terje Hvidsten are now connected to the Danish company Johnsen Oil, where large-scale trading of shares has taken place. All have previously been convicted.

German small savers have bought shares that price the company at NOK 6 billion with promises of stock exchange listing and possible industrial acquisitions.

Johnsen Oil has entered into a number of framework agreements, which can potentially generate large sales, which has led both German small savers and professional financiers in Abu Dhabi to find their wallets.

People in the sphere around ADIC, Abu Dhabi Investment Council, have, among other things, contributed 4.7 million euros.

- But damn it!

The Danish company Schrøder Partners and advisor Gert Mortensen have estimated Johnsen Oil to have a market value of 346 million euros, equivalent to 2.8 billion kroner at today's exchange rate.

This means a price per share of 7.3 euros per share.

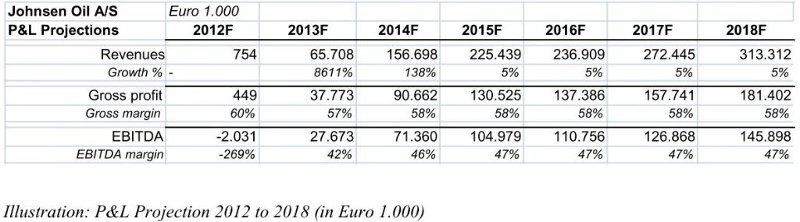

The explosive growth will then rise, until in 2018 there are operating revenues of just over NOK 2.5 billion. By the way, it is not only on the top line that the results will skyrocket, as the estimates below show.

- But damn it! How did you get an internal, confidential report? I would like to know that. It sounds like someone is trying to discredit the company, says Gert Mortensen to Nettavisen NA24.

- It is an incredibly strong growth you predict for the company in the future?

- It is clear in the memorandum what the turnover figures are based on. There is a set of framework agreements with a number of customers, distributors and potentially interested business partners. This is the basis for the expected turnover figures and the expected turnover growth. There are also a number of reservations present, says Mortensen.

- With such framework agreements, it is probably not so easy to calculate a present value. How has this been estimated?

- The value estimation only covers part of the framework agreements. It is clear that it has been difficult to estimate the existing distribution agreements. Then it works in the way that a professional investor gets access to these contracts and agreements through a due diligence, and can thus assess the substance of this, says Mortensen.

High pricing

The shares, on the other hand, have been sold to German small savers from various call centers in Southern Europe, some for as much as 16 euros each. This prices the company at almost six billion kroner.

The German lawyer Arno Meuser previously worked with the company, and knows it well. He says the following:

- That price is complete madness. It's ridiculous, and far from what I heard in my day. I do not know what has happened since, but it sounds like a huge mess, says Meuser to Nettavisen NA24.

Jan Ingolf Kristiansen from Asker owns over 80 per cent of the shares in the company, and this sale therefore prices the Kristiansen shareholding at around NOK 5 billion.

Johnsen Oil was founded in August 2005 by Jan Ingolf Kristiansen, with his son Leiv Are Kristiansen as an active player.

The company's product removes water and particles from the oil while the engine is running.

This should mean, for example, that you do not have to change the oil on the car and reduce the use of fuel.

The inventor will be Jan Ingolf Kristiansen.

With the patent in his back pocket and a potentially significant market, the Kristiansen family had apparently shot the golden bird.

Leiv Are Kristiansen is president and spokesperson for the company. He tells NA24 that it is not he and his father who have sold shares in the company to the German small savers. However, he states that they have tried to sell some shares via other networks to larger investors, without having succeeded to a large extent yet.

- My father, who is starting to get old, would like to realize a little to secure old age, says Leiv Are Kristiansen to Nettavisen NA24.

The online newspaper NA24 can now reveal that several of the country's most controversial financiers are, or have been, involved in the company.

One of those who was out early was Terje Hvidsten, a former art dealer who has been sentenced to long prison terms for gross fraud.

- I tried to sell a block at an early stage, but the share could not be moved because it was completely wrong price in relation to what the issue was at the time, and it was about two years ago. I came across a group in Sandefjord that wanted to buy shares at the time, if that was how it was outlined, but it never happened. The price at the time was 2.75 euros per share, says Hvidsten to Nettavisen NA24.

Hvidsten, who among other things has been convicted of giving money to a municipal employee at Asker and Bærum's tax office, states that he has not, or has had, anything to do with the company.

The online newspaper NA24 has internal documents stating that values have been transferred to Hvidsten.

Ole Petter Lindegaard confirms to NA24 that he has also been involved in Johnsen Oil.

- I started talking to Johnsen Oil and Are in late 2011. The dialogue was about finding shareholders for the company. Are contacted me via Terje Hvidsten, says Ole Petter Lindegaard to Nettavisen NA24.

He became rich when he was young, when his father listed the office supplies company Lindegaard in 1997. He has previously been sentenced to probation for accounting fraud and declared personal bankruptcy with claims of tens of millions.

- My role? Never had any role there

Now, however, it has all culminated in the Norwegians arguing so that the rags fly and the tufts of hair smoke.

- The quarrel is due to the fact that when the sellers have sold shares, they have done so on papers they have received from Are, about stock exchange listing, valuations and such things. Then there is no listing and then the customers are happy. Then the customers have turned around and complained, but then Are says that he does not know anything more about the sales, says Lindegaard.

A common denominator throughout the soup is that the parties talk to each other, and come up with divergent explanations.

Mannen som var en viktig brikke i salget til ADIC har følende å si.

- My role? Never had a role there, Helgesen informs Nettavisen NA24.

Helgesen has previously been convicted of gross fraud and is known to have close connections to the pyramid company T5PC. He is also known as a superseller and was declared bankrupt in 2001.

What he says, however, is contrary to what a number of the others involved claim.

- There is a money dispute between Kristian Helgesen and Are. Kristian says that he did not receive his commission. That is the review theme, everyone that Are has had anything to do with is in dispute with him, because they have not received their money, says Lindegaard.

- What they say is just bullshit

Hvidsten confirms that Helgesen has been involved. The same goes for the German lawyer Georg Meyer-Wahl, who has acted as settlement center.

- There has also been some trouble with Kristian Helgesen, who together with some friends, was the architect behind bringing in the people around ADIC in Abu Dhabi, says Meyer-Wahl.

Leiv Are Kristiansen himself states that he is innocent of it all.

- What these say is just bullshit, says Kristiansen.

He claims that it is Ole Petter Lindegaard who is behind the share sales.

Lindegaard, for his part, says that Kristiansen owes him many millions in commission related to Johnsen Oil, and that Kristiansen's lack of settlement is a melody in the whole case.

- Are blames everyone else for something he has started himself, says Lindegaard.

- I should never have trusted them

In the middle of nowhere is a desperate German lawyer in Heidelberg, who has been sued by Leiv Are Kristiansen.

- I should never have trusted them. Never, says Georg Meyer-Wahl to Nettavisen NA24.

165/5000 But this is far from everything in the piquant case, which Nettavisen NA24 will publish a number of articles about in the future.

But this is far from everything in the piquant case, which Nettavisen NA24 will publish a number of articles about in the future.

- Be aware that this is only a small part. Everyone is wild in that company there. There are some who claim that the company does not have the patents and so on. It's pretty hefty, what's going on.

BI professor Petter Gottschalk, who has written several books on economic crime, describes them this way.

- In this gang, there is a significant proportion of previously convicted white whites. Given that the risk of detection is very small for financial crime, this gang does not have much credibility, says Gottschalk, to Nettavisen NA24.

After the interview with Nettavisen NA24, Ole Petter Lindegaard wanted questions to be sent in writing to his lawyer. The online newspaper NA24 has been in contact with Lindegaard's defender John Christian Elden.

- I can confirm that I have been contacted by Ole Petter Lindegaad, who has requested a meeting. I will meet him on Friday, says Elden to Nettavisen NA24.

Do you have any tips in the case? Contact Ole Eikeland and Niels Ruben Ravnaas hereEND OF ARTICLE

Articles

- Kristian Helgesen Gross Fraud

- Sold Shares Without Permission

- Petty Criminal Swindler

- Fraudulent

- Kristian Helgesen Partners

- Jarl Moe Reviewed

- Jarl Moe Scam

- Loopium Scam

- One Coin Scam

- Ponzi Scheme

- Pyramid Leaders

- Pyramid Scams

- Kristian Helgesen Financial Acrobat

- Wanted Norwegian

- Convicted Norwegians

- Convicted Businessman

- Connected to Convicts

Related readings

- "Dr Ruja Ignatova was and may still be affiliated with Kristian Helgesen and Jarl Moe (aka Jarl Adelsten) , two notorious con artists on the run and believed to be in SE Asia."

- One Coin, Much Scam: OneCoin Exposed as Global MLM Ponzi Scheme

- Jarl Moe & Kristian Helgesen Ponzi Scheme

- Nanofixit YouTube Review

- Kristian Helgesen's Nanofixit trying to get into the phone insurance business

- Kristian Helgesen's Nanofixit trying to get into household cleaners

- Kristian Helgesen's Nanofixit trying to operate Insurance LTD in Malaysia

- Kris Helgesen and Jarl Moe trying to operate Nanofixit Philippines in SBMA (Subic Bay Metroplitan Authority)

- Danger Kristian Helgesen is now trying to live and operate Nanofixit in Dubai

- Nanofixit U.S. registration cancelled because International Registration cancelled in whole or in part

- The Onecoin Scam is trying to land in Ireland